Business expansion presents an exciting opportunity for growth and increased market share. However, moving too quickly can destabilize operations, while excessive caution may cause missed opportunities. Finding the right balance between speed and stability determines whether expansion succeeds or fails.

This comprehensive guide explores proven strategies for maintaining equilibrium during business growth. Entrepreneurs and executives can apply these principles to scale effectively while protecting their core operations.

Understanding the Speed-Stability Paradox

Rapid expansion generates momentum and captures market opportunities before competitors respond. Fast-growing companies attract investor attention, top talent, and media coverage. Additionally, quick scaling can establish market dominance in emerging industries.

Stability ensures sustainable growth built on solid foundations. Companies prioritizing stability maintain quality standards, preserve company culture, and protect customer relationships. Moreover, stable expansion reduces financial risks and operational disruptions.

The paradox emerges because pursuing one often compromises the other. Aggressive expansion strains resources and systems. Conversely, overly cautious approaches allow competitors to seize opportunities. Therefore, successful expansion requires strategic calibration rather than choosing one extreme.

Assessing Your Company’s Readiness for Expansion

Financial health provides the foundation for any expansion strategy. Review cash reserves, profit margins, and debt obligations before committing to growth. Companies should maintain emergency funds covering six months of operating expenses during expansion.

Operational capacity determines how much growth existing systems can handle. Evaluate whether current infrastructure, staff, and processes can scale effectively. However, don’t wait for perfect readiness, as some adaptation occurs during expansion itself.

Market conditions influence optimal expansion timing. Growing markets reward speed, while saturated markets require careful positioning. Research competitor activities, customer demand trends, and economic indicators before finalizing expansion plans.

Leadership bandwidth often gets overlooked in expansion planning. Executives must honestly assess whether they can manage increased complexity. Additionally, consider whether key team members possess skills needed for larger-scale operations.

Creating a Phased Expansion Framework

Phased approaches balance speed with stability by breaking expansion into manageable stages. Initial phases test assumptions with limited risk exposure. Successful pilot programs inform subsequent phases, creating data-driven expansion strategies.

Define clear milestones marking progression between phases. Each milestone should include measurable objectives like revenue targets, customer acquisition numbers, or operational benchmarks. Therefore, companies can pause and adjust if metrics indicate problems.

Build flexibility into phase timelines allowing acceleration or deceleration. Market conditions change rapidly, requiring responsive adjustment. However, maintain minimum standards each phase must achieve before advancing.

Pilot programs in limited markets provide valuable learning opportunities. Choose test markets representing broader expansion targets without betting entire growth strategies. Geographic, demographic, or product-line pilots reveal challenges before full-scale rollout.

Implementing Scalable Systems and Processes

Technology infrastructure must scale efficiently without constant overhauls. Cloud-based systems offer flexibility for growing companies. However, integration challenges arise when adding new platforms, so plan technology roadmaps carefully.

Standard operating procedures ensure consistency across expanding operations. Document core processes before expansion creates chaos. Additionally, systems should accommodate regional variations while maintaining quality standards.

Automation reduces dependency on proportional staff increases. Identify repetitive tasks suitable for automation before expansion accelerates. Moreover, automated systems provide data visibility crucial for managing distributed operations.

Quality control mechanisms prevent deterioration during rapid growth. Establish metrics monitoring product quality, customer satisfaction, and operational efficiency. Therefore, companies can identify problems early before they compound.

According to Harvard Business Review, founders often struggle balancing growth speed with maintaining control, with wealth-maximizing strategies sometimes requiring different approaches than control-preserving ones.

Building the Right Team for Expansion

Hiring strategies must balance immediate needs with long-term requirements. Avoid panic hiring during rapid expansion, as bad hires create lasting problems. However, understaffing overburdens existing employees and threatens stability.

Leadership depth provides stability during growth transitions. Develop multiple leaders capable of managing expanded operations. Additionally, succession planning ensures continuity if key personnel depart during demanding expansion periods.

Cultural preservation becomes challenging as headcount increases. Clearly articulate company values and integrate them into hiring processes. Moreover, regular communication and team-building activities maintain culture across growing organizations.

External expertise accelerates learning curves in unfamiliar territories. Consider hiring experienced executives who’ve scaled similar businesses. Consultants provide specialized knowledge without permanent payroll commitments during uncertain expansion phases.

Managing Financial Resources During Expansion

Cash flow management critically impacts expansion sustainability. Growth consumes cash through inventory, equipment, and hiring before generating returns. Therefore, maintain detailed cash flow projections extending 18-24 months into expansion timelines.

Funding sources should match expansion strategies and risk profiles. Bootstrapped growth offers maximum control but limits speed. Venture capital accelerates expansion but demands rapid returns. Additionally, debt financing provides capital without equity dilution but requires reliable revenue.

Cost control prevents expansion from destroying profitability. Monitor key expense ratios like customer acquisition costs and operational overhead percentages. However, avoid cutting essential investments that support quality and customer satisfaction.

Contingency reserves protect against expansion setbacks. Unexpected challenges inevitably arise during growth periods. Companies maintaining financial buffers can address problems without derailing entire expansion strategies.

Maintaining Customer Experience Quality

Customer service standards must remain consistent across expanding operations. Define service level agreements and train all customer-facing staff accordingly. Additionally, implement monitoring systems ensuring standards compliance across locations or channels.

Feedback mechanisms identify quality issues before they escalate. Regular customer surveys, reviews monitoring, and complaint tracking reveal problem patterns. Therefore, companies can address systemic issues rather than individual incidents.

Personalization becomes harder as customer bases grow. Invest in CRM systems maintaining relationship continuity despite organizational growth. However, balance automation efficiency with authentic human connection customers value.

Product quality consistency requires robust quality assurance programs. Establish testing protocols and inspection procedures preventing quality drift. Moreover, supplier relationships need management as volume demands increase.

Mitigating Expansion Risks

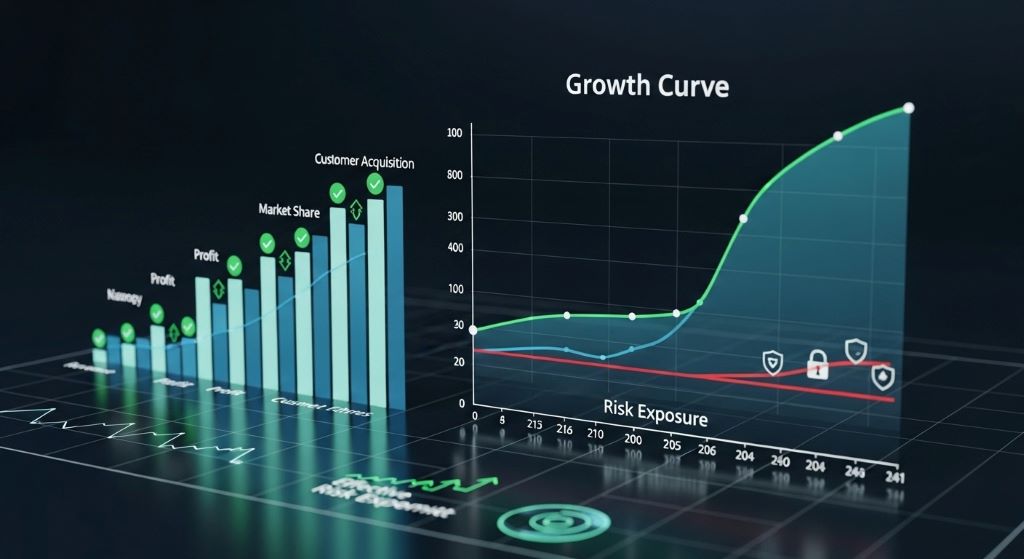

Risk assessment should identify potential expansion pitfalls before committing resources. Consider financial, operational, market, and reputational risks specific to your expansion strategy. Additionally, evaluate interconnected risks where one failure triggers cascading problems.

Diversification reduces dependency on single markets, products, or channels. Avoid concentrating expansion efforts too narrowly, which magnifies risk exposure. However, excessive diversification spreads resources too thin, so maintain strategic focus.

Exit strategies provide options if expansion underperforms. Define clear criteria triggering strategic pivots or withdrawals from markets. Therefore, companies can cut losses rather than pursuing failing expansion indefinitely.

Insurance and legal protections safeguard against specific risks. Liability coverage, key person insurance, and contractual protections limit downside exposure. Moreover, legal reviews prevent compliance failures in new jurisdictions.

According to Forbes, successful expansion requires carefully weighing risks against potential rewards while maintaining financial discipline throughout the growth process.

Monitoring Key Performance Indicators

Financial metrics reveal expansion health through revenue growth, profit margins, and return on investment. Track metrics monthly minimum, weekly during critical phases. However, short-term fluctuations shouldn’t trigger overreactions without confirming trends.

Operational KPIs measure execution efficiency and capacity utilization. Monitor production output, delivery times, and error rates across expanding operations. Additionally, employee productivity metrics indicate whether staffing levels match workload demands.

Customer metrics demonstrate whether expansion maintains service quality. Net promoter scores, retention rates, and lifetime customer value show relationship health. Therefore, declining customer metrics signal problems requiring immediate attention.

Market share indicators show competitive positioning in expansion markets. Track relative growth rates versus competitors and overall market expansion. Moreover, brand awareness measurements reveal marketing effectiveness in new territories.

Adjusting Strategy Based on Results

Regular strategy reviews prevent momentum from overriding judgment. Schedule quarterly expansion reviews evaluating performance against objectives. Additionally, create decision frameworks determining when to accelerate, maintain pace, or slow expansion.

Data-driven adjustments outperform gut-feeling decisions during expansion stress. Establish analytical processes examining performance data objectively. However, qualitative factors like employee morale and customer sentiment also deserve consideration.

Pivot mechanisms allow strategic course corrections without complete strategy abandonment. Define how significantly results must deviate before triggering pivots. Therefore, companies avoid both stubborn persistence and reactive thrashing.

Stakeholder communication maintains alignment during strategy adjustments. Investors, employees, and partners need understanding of changing expansion approaches. Moreover, transparent communication builds trust during challenging adaptation periods.

Learning from Expansion Failures and Successes

Post-mortem analysis of both successes and failures generates valuable insights. Document what worked, what failed, and why outcomes differed from expectations. Additionally, share learnings across organization preventing repeated mistakes.

Competitor case studies provide cautionary tales and inspiration. Study how similar companies approached expansion and their outcomes. However, recognize unique circumstances limiting direct comparisons.

Industry best practices offer frameworks applicable across sectors. Professional associations, business publications, and academic research provide expansion guidance. Moreover, networking with other executives facing similar challenges yields practical advice.

Continuous improvement mentality treats expansion as ongoing learning process. Each phase teaches lessons informing subsequent decisions. Therefore, companies become progressively better at balancing speed with stability.

Conclusion

Balancing speed versus stability in business expansion requires strategic thinking, disciplined execution, and continuous adjustment. Successful expansion strategies implement phased approaches, scalable systems, and robust risk management while maintaining customer experience quality. Financial discipline, appropriate staffing, and data-driven decision-making enable companies to grow rapidly without sacrificing operational stability. Therefore, businesses should assess readiness carefully, start with pilot programs, and adjust strategies based on measured results. The companies mastering this balance achieve sustainable growth outpacing cautious competitors while avoiding the instability plaguing overly aggressive expansion. Remember that optimal balance shifts based on market conditions, competitive dynamics, and organizational maturity, requiring ongoing strategic calibration.

Frequently Asked Questions

What percentage of revenue should companies reinvest in expansion efforts?

Most successful companies reinvest 20-40% of revenue in growth initiatives, though optimal percentages vary by industry and growth stage. Startups typically reinvest higher percentages, while mature companies balance expansion with profitability. Monitor cash flow carefully to ensure reinvestment doesn’t threaten operational stability.

How long should each expansion phase last before moving forward?

Expansion phases typically last 6-18 months depending on complexity and market conditions. Allow sufficient time to gather meaningful performance data and stabilize operations before advancing. However, remain flexible to accelerate if results significantly exceed expectations or competitors threaten market position.

When should a company slow or pause expansion plans?

Pause expansion when cash reserves drop below three months of operating expenses, customer satisfaction scores decline significantly, or employee turnover exceeds industry averages. Additionally, consider slowing during major economic uncertainty or when existing operations show quality deterioration requiring stabilization.

How many new markets or locations should businesses enter simultaneously?

Conservative strategies enter one new market at a time, while aggressive approaches tackle 3-5 simultaneously. Companies should consider management bandwidth, capital availability, and market similarity when deciding. Testing one market provides learning for subsequent expansion, while simultaneous entry captures opportunities faster.

What role should data analytics play in expansion decisions?

Data analytics should drive 70-80% of expansion decisions, with remaining percentage addressing qualitative factors like culture fit and strategic positioning. Track leading indicators predicting expansion success and establish data review processes informing strategy adjustments. However, avoid analysis paralysis preventing necessary action.

Related Topics:

Renewable Energy Marketing Strategy: A Comprehensive Guide to Boosting Your Green Business

How Does Marketing Influence the Competitiveness of an Organization?